Fire Damage Claims

Your trusted partner in navigating the aftermath of fire. Contact us today for a free consultation.

Maximize Your Fire Damage Claim With Precision Public Adjusting

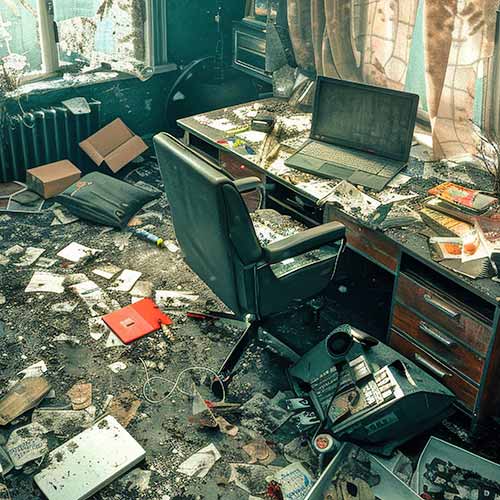

When disaster strikes in the form of a fire, the aftermath can be devastating. At Precision Public Adjusting, we understand the emotional and financial toll that fire damage can take on families and businesses. Our team of expert public adjusters is here to guide you through the complex process of filing and maximizing your fire damage insurance claim.

Understanding Fire Damage Claims

Fire damage claims are often among the most complex and challenging insurance claims to navigate. The destruction caused by fire is rarely limited to just the flames; smoke, soot, and water damage from firefighting efforts can compound the loss significantly.

Key Components of Fire Damage Claims

Structural Damage

This includes damage to walls, floors, roofs, and other building components

Content Loss

Personal belongings, furniture, and other items destroyed or damaged by fire, smoke, or water

Smoke and Soot Damage

Often overlooked, this can affect areas far from the fire’s origin

Water Damage

From firefighting efforts or burst pipes

Business Interruption

For commercial properties, this covers lost income during repairs

Additional Living Expenses

Costs incurred if you need to temporarily relocate

Why You Need a Public Adjuster for Your Fire Damage Claim

Navigating a fire damage claim can be overwhelming, especially when you’re dealing with the emotional aftermath of a fire. Here’s why partnering with Precision Public Adjusting can make a significant difference:

Expertise in Policy Interpretation

Insurance policies are complex documents filled with technical language. Our public adjusters are experts in policy interpretation, ensuring that you understand your coverage and that all applicable coverages are utilized in your claim.

Thorough Documentation

We meticulously document all aspects of your loss, including detailed inventory of damaged items, comprehensive photographic and video evidence, expert assessments of structural damage, and estimates for repairs and replacements.

Skilled Negotiation

Our adjusters are experienced negotiators who understand the tactics used by insurance companies. We advocate on your behalf, presenting your case effectively to secure the maximum compensation possible.

Time and Stress Savings

Dealing with a fire damage claim can be a full-time job. By handling all aspects of your claim, we allow you to focus on rebuilding your life or business while we take care of the complex claims process.

Maximized Settlements

On average, our clients receive settlements that are 30% higher than initial insurance company offers. Our expertise in identifying and valuing all aspects of your loss ensures you receive fair compensation.

We work to ensure that your commercial roof claim accounts for all necessary repairs or replacement, helping to protect your business investment.

Our Fire Damage Claims Process

At Precision Public Adjusting, we follow a proven process to handle your fire damage claim efficiently and effectively:

Initial Consultation and Assessment

We begin with a free, no-obligation consultation to assess your situation. Our team will:

- Review your insurance policy

- Conduct a preliminary assessment of the damage

- Explain the claims process and your options

Detailed Documentation

Our experts conduct a thorough evaluation of the fire damage, documenting:

- Structural damage

- Content loss

- Smoke and soot damage

- Water damage from firefighting efforts

We use state-of-the-art technology and industry-standard practices to ensure nothing is overlooked.

Policy Analysis

We carefully review your insurance policy to identify all applicable coverage, including:

- Dwelling coverage

- Personal property coverage

- Loss of use coverage

- Additional living expenses

Claim Preparation

We prepare a comprehensive claim that accurately represents the full extent of your losses. This includes:

- Detailed inventory of damaged items

- Repair and replacement cost estimates

- Documentation of additional living expenses

- Business interruption calculations (for commercial claims)

Claim Submission and Negotiation

We submit the claim on your behalf and handle all communications with the insurance company. Our skilled negotiators work tirelessly to secure the maximum settlement possible.

Settlement and Follow-Up

Once a fair settlement is reached, we ensure that all funds are properly disbursed. We remain available to address any questions or concerns that may arise even after the claim is settled.

Types of Fire Damage We Handle

Our team at Precision Public Adjusting has experience with a wide range of fire damage claims, including:

- Residential Fire Claims

- Single-family homes

- Apartments and condominiums

- Vacation properties

Commercial Fire Claims

- Office buildings

- Retail spaces

- Warehouses

- Manufacturing facilities

- Restaurants and hotels

Partial vs. Total Loss Claims

We handle both partial and total loss fire claims. In cases of total loss, we work to ensure that you receive the full value of your policy limits.

For partial losses, we ensure that all hidden damages are identified and included in your claim.

Common Challenges in Fire Damage Claims

Fire damage claims often present unique challenges. Here are some common issues we help our clients navigate:

Undervaluation of Smoke and Soot Damage

Insurance companies often underestimate the extent of smoke and soot damage. Our experts use specialized techniques to identify and document this damage, ensuring it’s properly addressed in your claim.

Disputes Over Pre-Existing Conditions

Insurers may attempt to deny coverage for certain damages by claiming they were pre-existing conditions. We gather evidence to prove that damages are directly related to the fire incident.

Disagreements on Scope of Repairs

There can be significant disagreements between policyholders and insurance companies regarding the necessary scope of repairs. Our team works with trusted contractors and experts to substantiate the need for specific repairs or replacements.

Delays in Claim Processing

Insurance companies may delay claim processing, causing financial strain for policyholders. We work to expedite the claims process and can help secure advance payments when necessary.

What to Do If Your Claim Is Denied

A denial doesn’t mean the end of your recovery. Fire damage claims can be denied for reasons like insufficient coverage, exclusions, suspected arson, misrepresentation, or paperwork errors. Start by requesting a written explanation if one isn’t provided.

Next Steps After a Denial:

- Review the Denial: Understand why the claim was rejected. Look for errors or misinterpretations.

- Check Your Policy: A public adjuster can help uncover hidden coverages.

- Gather Evidence: Collect photos, repair estimates, and all correspondence with your insurer.

- File an Appeal: Use the insurer’s appeals process to submit more documentation and explain your position.

- Consult a Public Adjuster: They can negotiate for you and help reverse unfair denials.

- Legal Support: If needed, a property damage attorney can help pursue further action.

At Precision Public Adjusting, we specialize in overturning denied fire claims. Let us review your case and fight for the compensation you deserve. Contact us today for a free consultation.

Why Choose Precision Public Adjusting for Your Fire Damage Claim?

Expertise

Our team has years of experience specifically handling fire damage claims. We understand the nuances of these complex claims and know how to navigate the challenges they present.

Client-Centric Approach

We prioritize your needs and work tirelessly to ensure you receive the settlement you deserve. Our goal is not just to settle your claim, but to maximize your recovery and help you rebuild.

Transparency

We believe in keeping our clients informed every step of the way. You’ll have access to real-time updates on your claim’s progress and can reach out to us at any time with questions or concerns.

Efficiency

We understand the importance of resolving your claim quickly. Our team strives for a 4-6 week turnaround time, allowing you to start repairs and get back to normal as soon as possible.

No Upfront Costs

We work on a contingency basis, meaning we only get paid when you receive your settlement. There are no upfront costs for our services.

Your Trusted Partner in Fire Damage Claims

Experiencing a fire can be one of the most traumatic events in a person’s life. At Precision Public Adjusting, we’re committed to being your advocate and guide through the complex process of recovering from fire damage. Our expertise, dedication, and client-focused approach ensure that you receive the fair compensation you deserve, allowing you to rebuild and move forward.

Don’t navigate the complexities of a fire damage claim alone. Let Precision Public Adjusting be your partner in recovery. Contact us today for a free consultation and take the first step towards fair compensation and peace of mind.

Remember, at Precision Public Adjusting, we don’t work for the insurance companies; we work for you. Our mission is to ensure that you receive every dollar you’re entitled to under your policy, helping you rebuild your home, your business, and your life after a fire.

Click to learn about home insurance claim adjuster secret tactics.

Our Service Area for Fire Damage Claims

At Precision Public Adjusting, we proudly assist homeowners and businesses with fire damage claims across Georgia, including Suwanee, Lawrenceville, Vinings, Marietta, Brookhaven, Buckhead, Dunwoody, Sandy Springs, Cumming, Dacula, Braselton, Augusta, Columbus, Savannah, Macon, and Athens. Our reach also extends beyond Georgia—we serve clients in Louisville, KY; Charleston, SC; Nashville, TN; Columbus, OH; Chicago, IL; Salt Lake City, UT; Reno, NV; Charlotte, NC; and many more cities nationwide. Wherever you are, we’re here to help you fight for the settlement you deserve.

Our Service Area

We are located in Atlanta, Georgia and work with business owners and homeowners throughout the Metro Atlanta cities of Suwanee, Lawrenceville, Vinings, Marietta, Brookhaven, Buckhead, Dunwoody, Sandy Springs, Cumming, Dacula, Braselton, as well as other Georgia regions including, Augusta, Columbus, Savannah, Macon and Athens, while also operating in Louisville, KY, Charleston, SC, Nashville TN, Columbus, OH, Chicago, IL, Salt Lake City, Reno, NV, Charlotte, NC, and more.

States of Operation: North Carolina, South Carolina, Tennessee, Kentucky, Ohio, Illinois, Utah, Nevada and Mississippi. Don't see your state? Contact us today to see how we can help.

Quick Contact Form

Main Office

3594 Baxley Point Dr

Suwanee, GA 30024

Hours

Monday-Friday: 8:30am - 5:00pm