Fire Damage Claims In Braselton, GA

Struggling with a fire damage claim or denial in Braselton, GA? Precision Public Adjusting fights for your full insurance payout. Get expert help—call now!

Fire Damage Claims: Your Trusted Partner for Insurance Success

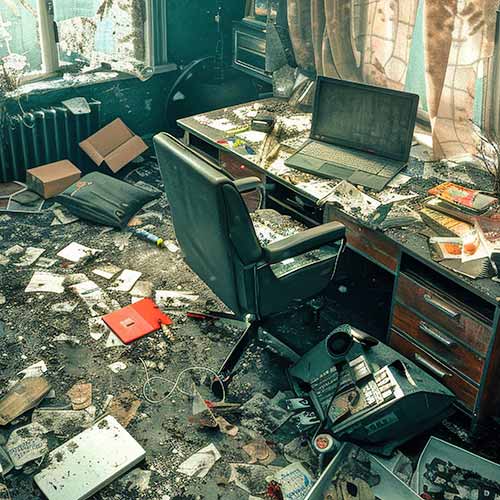

When a fire strikes your home or business in Braselton, GA, the aftermath can be overwhelming. From structural destruction to smoke and soot infiltration, fire damage leaves property owners facing not only emotional distress but also complex insurance hurdles. Precision Public Adjusting is here to guide you through every step of your fire damage claim—especially if your claim has been denied or underpaid. Our expert team ensures you get the compensation you deserve, so you can focus on recovery and rebuilding.

Understanding Fire Damage Claims

A fire can devastate your property in minutes, but the insurance claim process can drag on for months—unless you have an expert on your side. Fire damage claims are among the most complex insurance claims, involving:

Structural damage to walls, roofs, and foundations

Loss of personal belongings, inventory, and business equipment

Smoke and soot contamination of surfaces and HVAC systems

Water damage from firefighting efforts

What to Do After a Fire: Immediate Steps for Property Owners

Ensure Safety

Wait for official clearance before re-entering your property.

Notify Your Insurer Promptly

Georgia policies require “immediate written notice” of loss.

Document Everything

Take photos and videos of all damage, and create a detailed inventory of lost or damaged items.

Don’t Discard Damaged Items

These serve as proof for your claim.

Contact Precision Public Adjusting

The sooner we get involved, the better we can protect your interests.

Common Challenges in Fire Damage Claims

Insurance companies often look for ways to minimize payouts or deny claims outright. Common issues include:

- Undervaluation of Smoke and Soot Damage: Insurers may underestimate the true extent of contamination, leaving you with lingering odors and health hazards.

- Disputes Over Pre-Existing Conditions: Insurers might claim some damage predates the fire, reducing your settlement.

- Delays in Claim Processing: Prolonged investigations and requests for more documentation can stall your recovery.

- Disagreements on Scope of Repairs: Insurers may argue for cheaper, inadequate repairs.

Precision Public Adjusting’s team uses advanced technology and industry expertise to counter these tactics and substantiate your claim.

Denied Fire Damage Claims: Why They Happen and How We Help

Receiving a denial on your fire damage insurance claim can feel like a second disaster—adding stress and uncertainty to an already difficult situation. Unfortunately, there are several common reasons why claims get denied:

- Insufficient Documentation: If your claim lacks detailed photos, reports, or receipts, the insurance company may argue there isn’t enough evidence to support it.

- Coverage Exclusions: Some fire-related events—such as wildfires, arson, or accidental outdoor fires—might be specifically excluded under your policy.

- Fire Safety Negligence: If the insurer believes that you failed to maintain smoke detectors, fire alarms, or follow local fire safety codes, they may use it as grounds for denial.

- Suspicions of Fraud or Arson: Insurance providers may allege that the fire was intentional or suspicious in origin, often without conclusive evidence, as a tactic to avoid payment.

- Disputes Over Policy Language: Vague or complex terms within your insurance policy can be interpreted in the company’s favor, leaving you without coverage when you need it most.

If your fire damage claim has been denied, Precision Public Adjusting is here to help you fight back. Our team will:

- Thoroughly review your denial letter and insurance policy to identify where your claim went wrong—and how it can be corrected.

- Gather, organize, and submit all the necessary documentation, including detailed damage assessments, repair estimates, and expert opinions.

- Prepare a persuasive and well-supported appeal while negotiating directly with your insurance company to push for a reversal of the denial.

- If needed, we’ll connect you with experienced legal professionals who can escalate the matter and pursue your rights in court.

- You don’t have to navigate this alone—our experts are here to help turn your denial into a fair settlement.

Our Proven Fire Damage Claims Process

Free Consultation & Policy Review

We start with a no-obligation assessment of your situation and insurance policy.

Comprehensive Damage Documentation

Our experts conduct a detailed evaluation, documenting everything from structural damage to contents loss, including hidden smoke and water damage.

Full Claim Preparation

We prepare a robust claim package, including repair estimates, inventory lists, and proof of additional living expenses or business interruption losses.

Direct Negotiation with Insurers

Precision Public Adjusting handles all communications, negotiations, and follow-ups with your insurance company, fighting for the maximum settlement5.

Settlement & Ongoing Support

Once your claim is settled, we ensure all funds are properly disbursed and remain available for any post-settlement questions or concerns.

Residential & Commercial Fire Damage Claims

We serve both homeowners and businesses in Braselton:

Residential Claims

Single-family homes, condos, and vacation properties.

Commercial Claims

Offices, retail spaces, warehouses, restaurants, and hotels.

Partial & Total Losses

Whether your property is partially damaged or a total loss, we ensure your claim reflects the full scope of your policy.

Why Choose Precision Public Adjusting?

Local Expertise

At Precision Public Adjusting, we bring deep local knowledge to every claim. Our team understands the unique insurance landscape of this region, including the challenges that homeowners and business owners often face when dealing with property damage. With a strong and proven track record of success, we’ve proudly served countless clients throughout the area—delivering personalized service and real results.

Comprehensive Assessments

We don’t just take a quick look and move on. Our experienced adjusters conduct detailed, comprehensive assessments of your property to identify all fire and smoke damage—both visible and hidden. This meticulous documentation process ensures that every detail is accounted for, giving your claim the best chance for a full and accurate settlement.

Aggressive Advocacy

When it comes to dealing with insurance companies, we’re relentless. Whether your claim has been underpaid, denied, or delayed, our team steps in to represent your interests. We negotiate directly with your insurer and fight to secure the maximum compensation you’re entitled to—so you can focus on recovery instead of red tape.

No Upfront Fees

Worried about the cost? Don’t be. At Precision Public Adjusting, you don’t pay a dime unless we successfully recover money on your behalf. It’s that simple—our success is tied directly to yours.

Get the Fire Damage Settlement You Deserve

Don’t let insurance red tape stand between you and your recovery. Precision Public Adjusting is Braselton’s trusted advocate for fire damage claims, including denied and underpaid claims. Our experienced team will fight for your full payout—so you can rebuild with confidence.

Call Precision Public Adjusting today for a free, no-obligation consultation and let us handle your fire damage claim from start to finish. Your recovery starts here.

Frequently Asked Questions

How long do I have to file a fire damage claim in Georgia?

Georgia policies require immediate written notice—don’t delay, as waiting can jeopardize your claim.

What if my claim is underpaid or delayed?

Contact Precision Public Adjusting. We can review your settlement and negotiate for a higher payout if you’ve been shortchanged.

Do I need a public adjuster if my claim was denied?

Absolutely. A public adjuster specializes in overturning wrongful denials and maximizing your recovery without unnecessary litigation.

Can I reopen a fire damage claim if new damage is discovered after settlement?

Yes, in many cases you can reopen a fire damage claim if additional damage related to the original fire is discovered after your claim has been settled. Precision Public Adjusting can review your policy and settlement to determine if you qualify for supplemental claims and help you gather the necessary documentation to pursue additional compensation.

How does Precision Public Adjusting get paid for handling my fire damage claim?

We work on a contingency fee basis, meaning you pay nothing upfront. Our fee is a small percentage of the settlement we secure for you. If we don’t recover additional funds, you owe us nothing—so there’s no risk in having us advocate for your fire damage claim.

Our Service Area

We are located in Atlanta, Georgia and work with business owners and homeowners throughout the Metro Atlanta cities of Suwanee, Lawrenceville, Vinings, Marietta, Brookhaven, Buckhead, Dunwoody, Sandy Springs, Cumming, Dacula, Braselton, as well as other Georgia regions including, Augusta, Columbus, Savannah, Macon and Athens, while also operating in Louisville, KY, Charleston, SC, Nashville TN, Columbus, OH, Chicago, IL, Salt Lake City, Reno, NV, Charlotte, NC, and more.

States of Operation: North Carolina, South Carolina, Tennessee, Kentucky, Ohio, Illinois, Utah, Nevada and Mississippi. Don't see your state? Contact us today to see how we can help.

Quick Contact Form

Main Office

3594 Baxley Point Dr

Suwanee, GA 30024

Hours

Monday-Friday: 8:30am - 5:00pm