Fire Damage Claims In Dunwoody, GA

Struggling with a fire damage claim or denial in Dunwoody, GA? Precision Public Adjusting fights for your full insurance payout. Get expert help—call now!

Fire Damage Claims: Maximize Your Settlement with Precision Public Adjusting

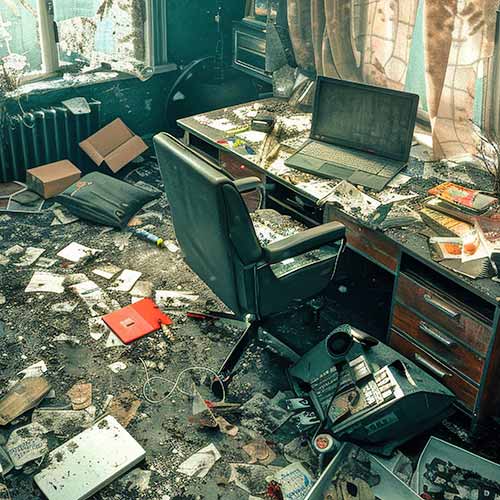

A fire can turn your life upside down in an instant. If your Dunwoody home or business has been damaged, the last thing you need is the added stress of navigating a complicated insurance claim. That’s where Precision Public Adjusting comes in. We act as your trusted advocate, working to secure the full compensation you deserve—even for denied or underpaid claims. With our local expertise, proven experience, and relentless commitment to your recovery, you can focus on rebuilding while we handle the rest.

Why Property Owners Trust Precision Public Adjusting

Thorough Assessments

We document all visible and hidden fire, smoke, and water damage.

Policy Expertise

We interpret complex policies to maximize your payout.

Aggressive Negotiation

We fight for fair settlements—even on denied claims.

No Upfront Fees

You pay only if we recover money for you.

The Fire Damage Claim Process

Filing a fire damage claim can be stressful—especially when insurers undervalue, delay, or deny your claim. At Precision Public Adjusting, we simplify the process and advocate for your full recovery with a proven approach:

Policy Review

We examine your insurance policy to identify all eligible coverages.

Damage Documentation

Our team records all fire, smoke, and water damage, including structural and contents loss.

Claim Submission

We compile a thorough claim and manage all communication with your insurer.

Negotiation

We fight for the maximum settlement and keep you updated throughout.

Ongoing Support

If new damage is found, we’re here to help with follow-up claims or questions.

Denied Fire Damage Claims: Your Second Chance at Recovery

A denied fire damage insurance claim can feel like a major setback—but it doesn’t have to be the end of your recovery journey. In many cases, claim denials are based on issues that can be challenged and corrected with the right approach and expertise.

Common reasons for denial include:

- Insufficient Documentation: Missing photos, reports, or repair estimates can cause insurers to question the legitimacy or extent of the damage.

- Policy Exclusions: Certain types of fires—such as those caused by arson, wildfires, or negligence—may be excluded from coverage under standard policies.

- Disputes Over Cause or Extent of Damage: Insurance companies may downplay or misinterpret the true scope of damage, or dispute the cause to reduce their payout obligations.

At Precision Public Adjusting, we specialize in helping policyholders overcome these roadblocks and get the compensation they deserve. When your claim is denied, our team takes immediate action by:

- Reviewing Your Denial Letter and Policy in Detail: We carefully analyze every clause and line item to understand why your claim was rejected and identify the best course of action.

- Gathering Additional Evidence and Expert Reports: From fire restoration specialists to building contractors and engineers, we assemble all the professional support needed to strengthen your claim.

- Preparing a Strong, Compelling Appeal: Our adjusters craft a well-documented, evidence-backed appeal and communicate directly with your insurance company to negotiate a fair resolution.

- Advising on Further Legal Options: If the insurer refuses to cooperate, we can connect you with trusted legal professionals who are experienced in insurance claim litigation.

Don’t let an initial denial prevent you from rebuilding your home or business. With Precision Public Adjusting on your side, you gain a dedicated team of advocates committed to fighting for your rightful recovery.

Serving Homeowners and Businesses

At Precision Public Adjusting, we’re proud to provide expert claims assistance to a wide range of clients across the community. Our services are designed to support not only individual homeowners but also larger organizations and commercial entities facing the challenges of fire damage recovery. We work with:

Homeowners

Helping individuals and families restore their homes and peace of mind after fire-related losses.

Business Owners

Minimizing downtime and financial disruption by securing fair settlements that support business continuity.

Property Management Companies

Coordinating complex claims for multi-unit dwellings, rental properties, and large residential developments.

Churches and Non-Profits

Assisting community organizations in preserving their mission and rebuilding after unexpected damage.

Contractors

Partnering with construction professionals to support claim documentation, damage assessment, and repair coordination.

Whether you’re dealing with minor smoke damage or a catastrophic structural loss, we tailor our approach to meet the specific needs of your property type and situation. Every claim is handled with care, precision, and a deep commitment to securing the best possible outcome for our clients.

The Precision Advantage: Why Work With a Public Adjuster?

When disaster strikes, navigating the insurance claims process can be overwhelming and frustrating—especially when you’re already dealing with the emotional and financial toll of property damage. That’s where Precision Public Adjusting steps in. Here’s what sets us apart and why partnering with a public adjuster can make all the difference:

Unbiased Representation

Unlike insurance company adjusters who protect the insurer’s bottom line, we work exclusively for you—the policyholder. Our sole priority is to ensure your best interests are represented and that you receive every dollar you’re entitled to under your policy.

Higher Settlements

Statistics show that insurance claims handled by public adjusters result in substantially higher payouts than those managed by policyholders alone. Our in-depth knowledge of insurance policies, combined with expert damage assessments and strategic negotiation, often leads to significantly improved financial outcomes.

Stress-Free Process

Dealing with insurance forms, documentation requirements, and ongoing communication with adjusters can be exhausting. We handle every detail of the claims process on your behalf—from initial inspection and paperwork to negotiating the final settlement—so you can focus on recovery and rebuilding without added stress.

Transparent Communication

You’ll never be left in the dark. We provide clear, consistent updates and walk you through each step of the process. Our team believes in open communication, so you’ll always know what’s happening with your claim and what to expect next.

Start Your Fire Damage Claim Today

Don’t let insurance company tactics or denied claims stand in the way of your recovery. Precision Public Adjusting is Dunwoody’s trusted partner for fire damage claims of all sizes. Our local experts are ready to fight for your maximum settlement—no upfront costs, no stress, just results.

Call Precision Public Adjusting now for a free, no-obligation claim assessment and let us help you rebuild with confidence. Your recovery starts here.

Frequently Asked Questions

How soon should I contact a public adjuster after fire damage?

It’s best to contact a public adjuster as soon as possible after a fire. Early involvement allows us to document the full extent of the damage before repairs begin or evidence is lost, maximizing your claim potential.

Can Precision Public Adjusting help if my insurance company is slow to respond?

Yes. If your insurer is delaying your claim, our team can step in to expedite the process, apply pressure for timely responses, and ensure your claim is not unfairly stalled or underpaid.

What types of fire damage are typically covered by homeowners insurance?

Most homeowners insurance policies cover damage caused by accidental fires, including structural damage, smoke and soot contamination, and loss of personal belongings. Some policies may also cover additional living expenses if your home is uninhabitable. However, exclusions may apply for intentional acts, certain types of wildfires, or lack of maintenance, so it’s important to have an expert review your policy.

Can I file a claim for fire damage to my business or commercial property?

Absolutely. Precision Public Adjusting assists business owners and commercial property managers with fire damage claims. We help document damage to buildings, inventory, equipment, and loss of business income, ensuring your claim reflects the full scope of your losses.

What if I already started repairs before filing my claim?

While it’s best to document all damage before making repairs, we understand that emergency repairs may be necessary to protect your property. Keep all receipts and take photos before and after repairs. Our team can help you compile the necessary documentation and ensure your claim includes all eligible expenses.

Our Service Area

We are located in Atlanta, Georgia and work with business owners and homeowners throughout the Metro Atlanta cities of Suwanee, Lawrenceville, Vinings, Marietta, Brookhaven, Buckhead, Dunwoody, Sandy Springs, Cumming, Dacula, Braselton, as well as other Georgia regions including, Augusta, Columbus, Savannah, Macon and Athens, while also operating in Louisville, KY, Charleston, SC, Nashville TN, Columbus, OH, Chicago, IL, Salt Lake City, Reno, NV, Charlotte, NC, and more.

States of Operation: North Carolina, South Carolina, Tennessee, Kentucky, Ohio, Illinois, Utah, Nevada and Mississippi. Don't see your state? Contact us today to see how we can help.

Quick Contact Form

Main Office

3594 Baxley Point Dr

Suwanee, GA 30024

Hours

Monday-Friday: 8:30am - 5:00pm